Restaurant equipment depreciation calculator

A prime supply store will offer every element fundamental for a flourishing restaurant business fitted to the demands of the food-industry. 67 rows See the Cost Segregation Audit Techniques Guide for additional guidance.

1

Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

. There are three depreciation formulas. Calculate your equipment value now. The tax is due on the 15th day of the third for S corporations or fourth.

Next youll divide each years digit by the sum. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. This depreciation calculator is for calculating the depreciation schedule of an asset.

This calculator computes the residual value to satisfy a known payment amount cost and useful life in years. This depreciation calculator will determine the actual cash value of your Stainless Steel using a replacement value and a 20-year lifespan which equates to 02 annual depreciation. The fundamental way to calculate.

Also includes a specialized real estate property calculator. Section 179 deduction dollar limits. The calculator should be used as a general guide only.

The 1 buyout lease a capital lease in which the lessee makes fixed. See also Revenue Procedure 2002-12 IRB. Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax.

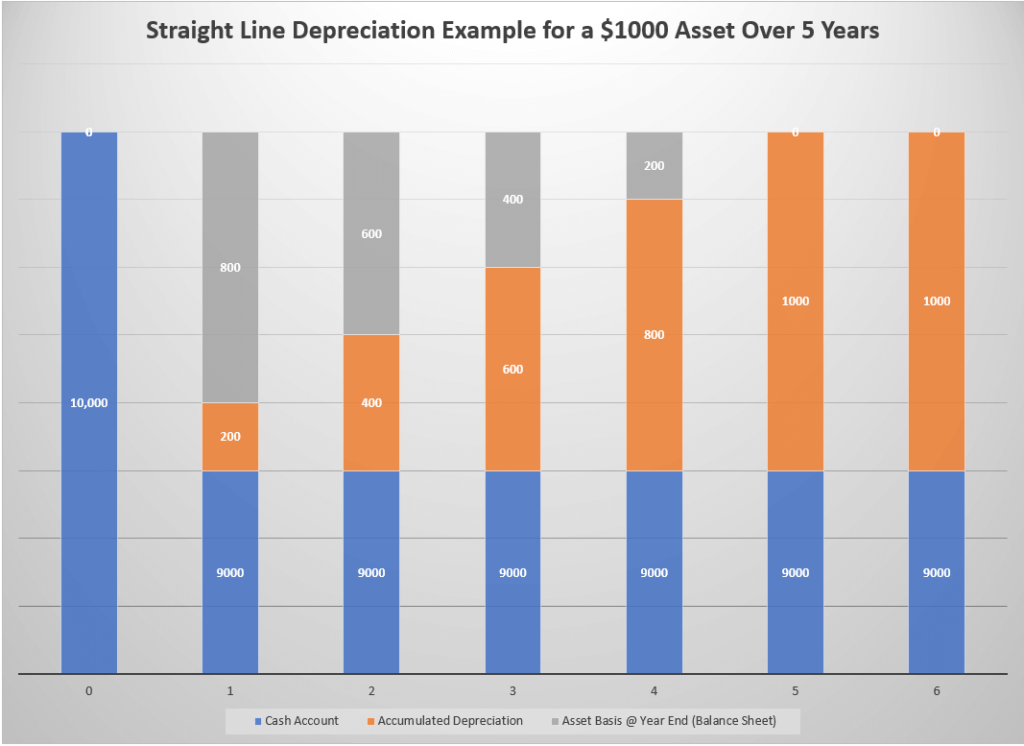

Straight-line depreciation Initial equipment cost useful life. 07 2002 for the proper treatment of. 800 AM - 100 PM NY by Appt Only.

VT NH Open Mon - Fri. In 2016 you would continue to depreciate the property until you stopped using it for business. So if you purchased equipment for 25000 in 2015 you would claim the depreciation in 2015.

This limit is reduced by the amount by which the cost of. Kitchen Equipment Depreciation Calculator The calculator should be used as a general. That in service date is when depreciation starts.

There are many variables which can affect an items life expectancy that should be taken into consideration. 800 AM - 500 PM Showroom Closures MA Open Mon - Fri. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

7 6 5 4 3 2 1 28. YEARS WITH 413 459. Website Directions More Info.

With our calculator you can choose from three of the most popular equipment lease types to calculate your payments. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Every day a restaurant needs diverse food service.

Restaurant Equipment Supplies Food Processing Equipment Supplies Fine Art Artists. In other words the. 7 6 5 4 3 2 1 28.

What Are The Seven Areas Of Home Economics Synonym Budgeting Quickbooks Home Economics

1

Depreciation Expense Depreciation Expense Accountingcoach

How To Calculate Depreciation Expense For Business

How To Calculate A Machine S Depreciation Sapling Com Bookkeeping Business Bookkeeping Online Business Opportunities

1

How To Start A Home Business 1 2 3 Home Business Center Inc Laundry Business Laundry Service Business Laundromat Business

Depreciation On Equipment Definition Calculation Examples

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

What Is Equipment Depreciation And How To Calculate It

Depreciation Expense Depreciation Expense Accountingcoach

Appliance Depreciation Calculator

What Is Equipment Depreciation And How To Calculate It

Depreciation Expense Depreciation Expense Accountingcoach

1

Prime Cost Calculation Great Article On How How Food And Labor Costs Are Calculated Food Cost Restaurant Management Food Truck

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting